Maximize your small business deductions and minimize your tax burden with Stephen Fishman's Deduct It!: Lower Your Small Business Taxes. This essential guide provides clear, concise explanations and real-world examples to help you legally reduce your tax liability. Whether you're a startup or an established business, Deduct It! covers a wide range of deductible expenses, including start-up costs, travel, home offices, equipment, and more. Learn about crucial deductions like net operating losses, Section 179 expensing, bonus depreciation, and the 20% pass-through deduction. This updated edition also includes vital information on electric vehicle tax credits and beneficial ownership reporting requirements, ensuring you're compliant and saving as much as possible. Deduct It! is your key to significant tax savings.

Review Deduct It!

Okay, let's talk about "Deduct It!: Lower Your Small Business Taxes." This book isn't just another dry tax guide; it's a lifeline for small business owners like me, juggling everything from invoices to inventory. I've actually owned a previous edition, and this one’s even better! The friendly, straightforward approach is what really sets it apart. It doesn't bog you down in complicated legal jargon; instead, it uses clear, concise language and real-world examples that make even the trickiest tax concepts understandable. Seriously, I felt like I was having a conversation with a knowledgeable tax advisor, not struggling through a dense textbook.

One thing I absolutely loved was the practical application. The authors don’t just tell you what deductions you can take; they show you how to do it. This isn't some theoretical exercise; these are strategies you can implement immediately to reduce your tax burden. The examples are fantastic; they walk you through different scenarios and demonstrate exactly how to apply the rules. This is crucial, especially for those of us who aren't tax experts. It takes the mystery and fear out of tax season, transforming it from a stressful ordeal into a manageable process.

The book covers a wide range of deductions, from the common ones like home office expenses and travel, to more nuanced topics like net operating losses and the 20% pass-through deduction. It’s incredibly comprehensive, acting as a one-stop shop for all your small business tax needs. The updated sections on electric vehicle credits and the beneficial ownership information report are also incredibly helpful, showing that the authors are constantly updating the book to reflect current legislation. This ensures that you’re always working with the most accurate and relevant information available.

While some reviews mention issues with receiving the wrong book, my experience has been consistently positive. I especially appreciate the forward-thinking approach – it doesn't just focus on the current tax year; it also offers strategies to help you plan for future tax savings. This is a huge advantage, allowing you to proactively minimize your tax liability, rather than just reacting to it after the fact. Essentially, it empowers you to take control of your finances and make informed decisions throughout the year.

In short, "Deduct It!" is an invaluable resource for any small business owner. It’s easy to read, incredibly informative, and provides practical strategies that can significantly impact your bottom line. If you're serious about maximizing your business deductions legally and efficiently, this is a must-have book. It's an investment that will pay for itself many times over, saving you money and headaches in the long run. It's simply the best tax book I've ever encountered for small business owners – a true game-changer.

Information

- Dimensions: 7 x 1.5 x 9 inches

- Language: English

- Print length: 464

- Publication date: 2024

- Publisher: NOLO

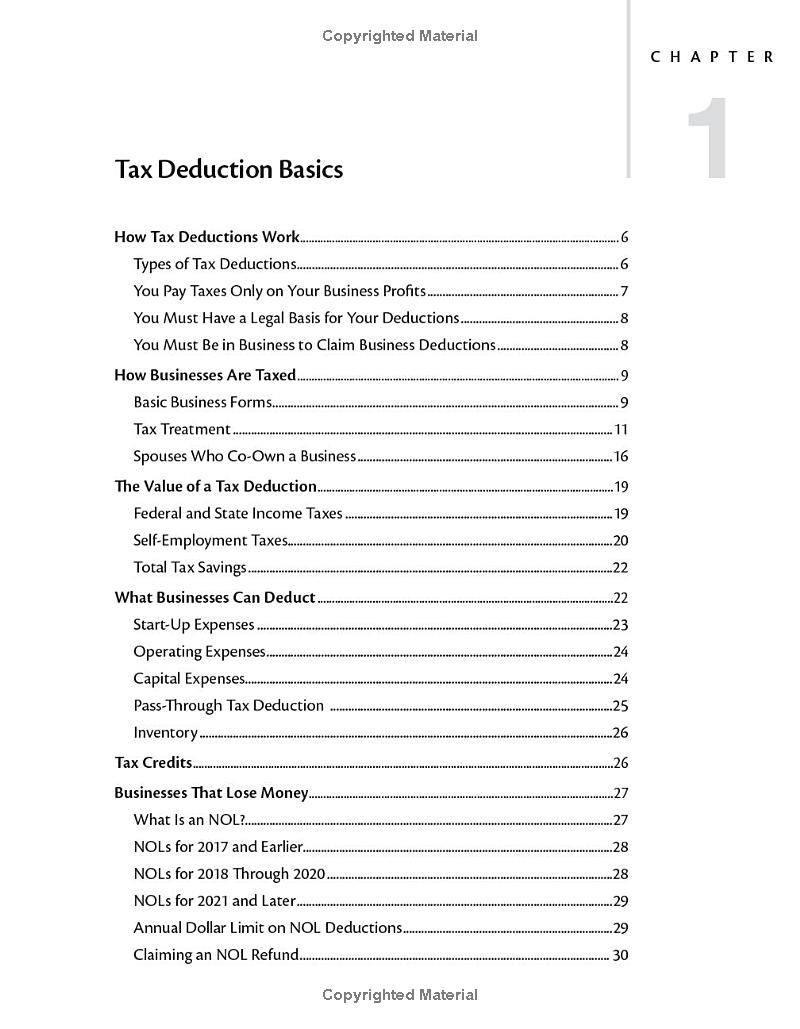

Book table of contents

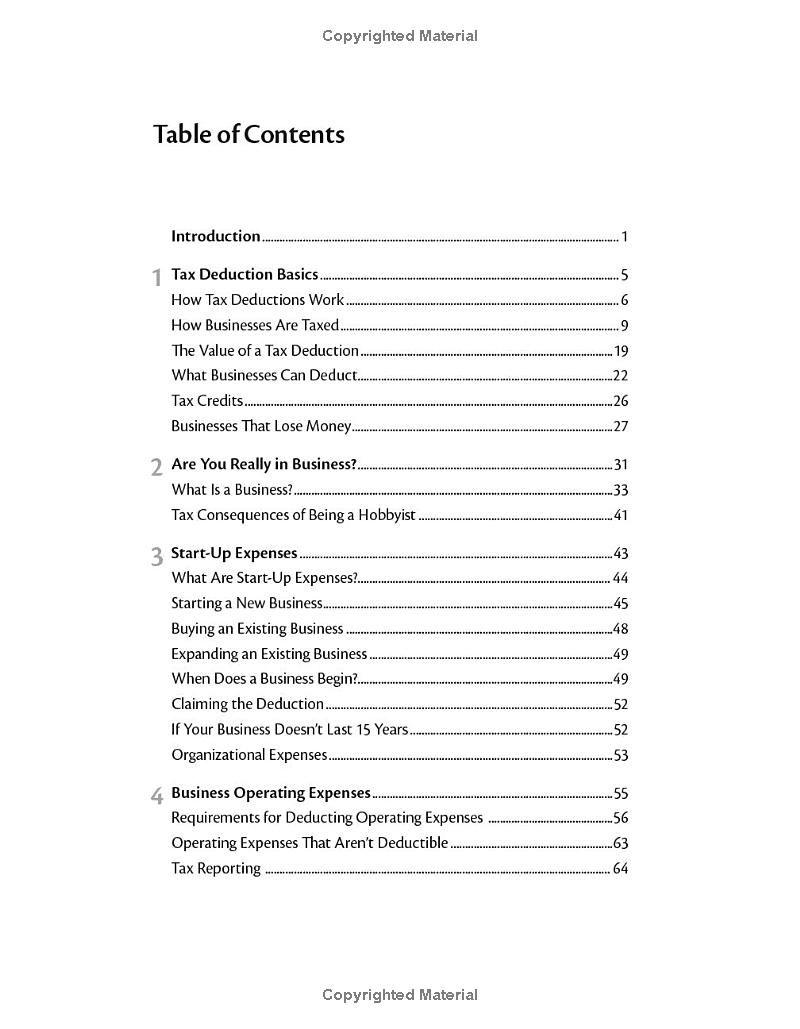

- Introduction

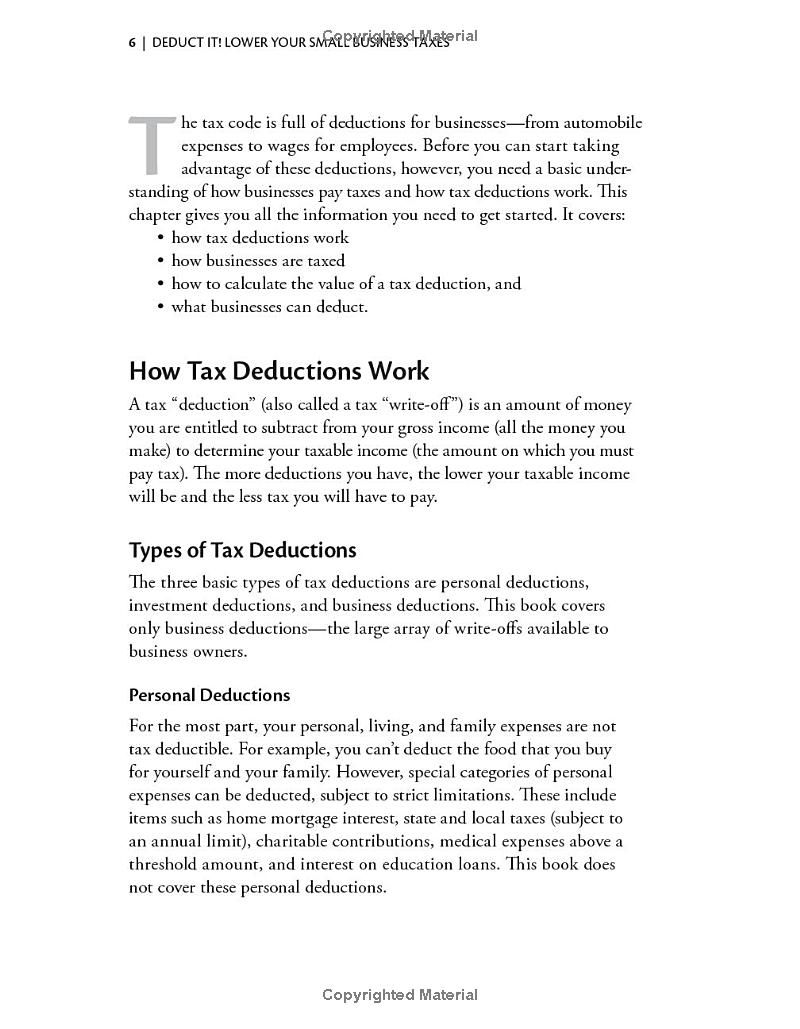

- Tax Deduction Basics

- How Tax Deductions Work

- How Businesses Are Taxed

- The Value of Tax Deduction

- What Businesses Can Deducu.

- Tax Credits

- Businesses Thar Lose Money .

- Are You Really in Business?

- What Is a Business?

- Tax Consequences of Being Hobbyist

- Start-Up Expenses _

- What Are Start-Up Expenses?.

- Starcing a New Business_

- Buying an Existing Business

Preview Book